salt tax cap mortgage interest

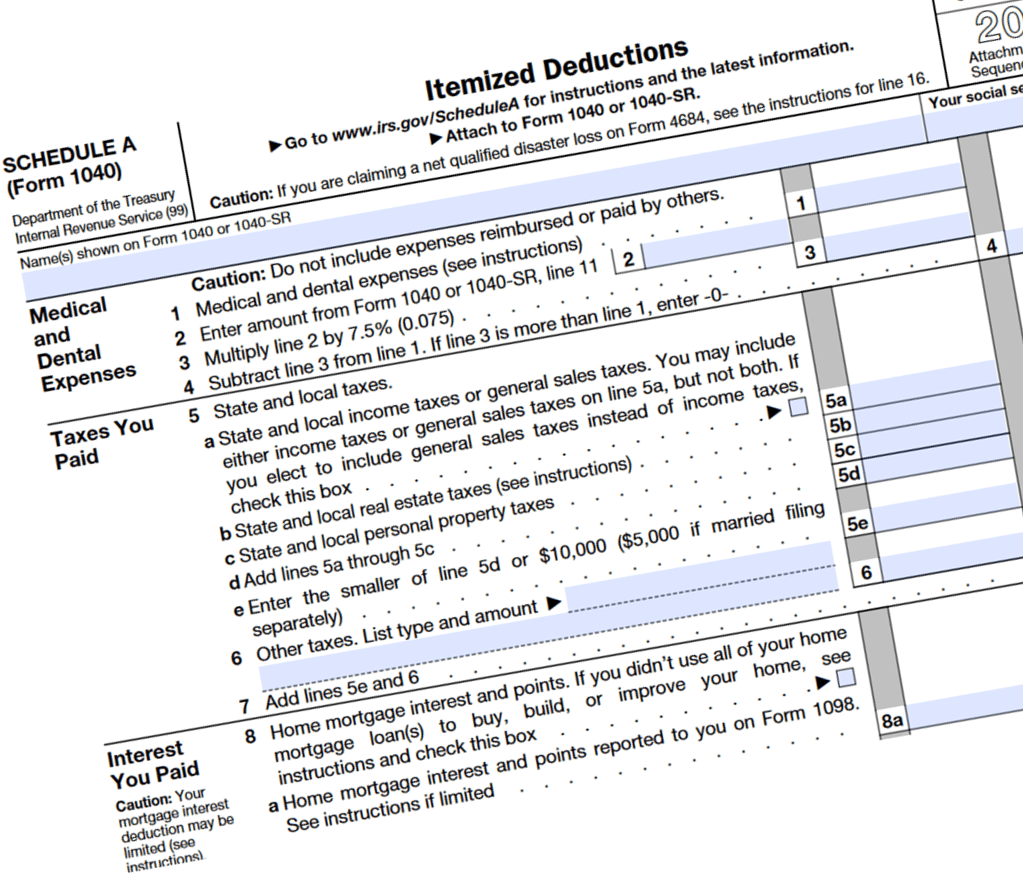

The Tax Cuts and Jobs Act which took effect in 2018 capped the maximum SALT deduction to 10000 5000 for married individuals filing separately. Capping the SALT deduction also exacerbates a well-known problem in the federal tax code.

Your 2020 Guide To Tax Deductions The Motley Fool

Second the 2017 law capped the SALT deduction at 10000 5000 if youre married and file separately from your spouse.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

. That limit applies to all. This cap remains unchanged for your 2021 taxes and it will remain the same in. 52 rows The deduction has a cap of 5000 if your filing status is married filing separately.

It merely reallocates the tax burden from federal to state and local governments. SALT refers to the state and local taxes associated with a federal income tax deduction for taxpayers that itemize their deductions. A 10000 ceiling on the previously.

Another proposal is to increase the cap on the SALT deduction to 15000 for individual filers and 30000 for joint filers. This means you can deduct no more than. Fundamentally changed the federal tax treatment of state and local tax SALT deductions that had underpinned the federal fiscal policies promoting homeownership and statelocal.

When the trump TCJA ends in 2025 does that mean pending more failed democrat legislation that we can deduct unlimited SALT and deduct interest up to 1m not 750k or is it based on.

:max_bytes(150000):strip_icc()/Tax_Advantages_Buying_Home_Sketch-ffc74833ef7744f2ba7377009ff52274.png)

Top Tax Advantages Of Buying A Home

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

2022 Income Tax Brackets And The New Ideal Income

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Salt Cap Repeal Salt Deduction And Who Benefits From It

Solved Question 1 1 Point Which Of The Following Chegg Com

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

How Does A Refinance In 2021 Affect Your Taxes Hsh Com

State And Local Tax Salt Deduction What It Is How It Works Bankrate

The Price We Pay For Capping The Salt Deduction Tax Policy Center

The Salt Tax Deduction Is A Handout To The Rich It Should Be Eliminated Not Expanded

State Local Taxes Salt Mortgage Deductions Explained

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

How Raising The Salt Deduction Limit To 80 000 May Affect Your Taxes

Bunching Deductions To Save On Taxes Principia Wealth Advisory